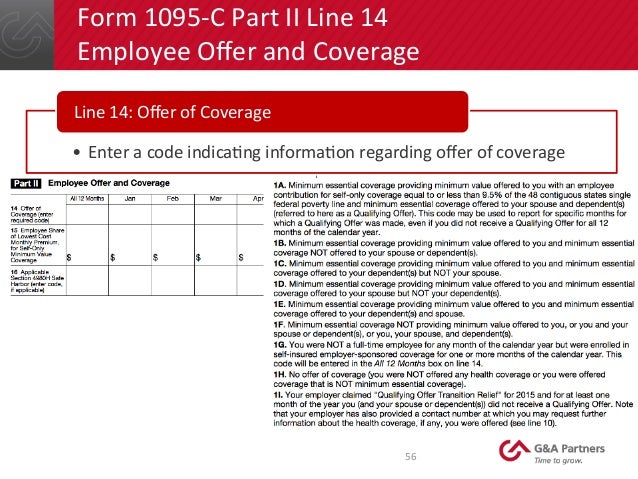

Form 1095C Line 14–Code Series 1 A Series 1 code must be entered in line 14 to indicate the type of coverage offered (or no coverage offered) to the employee and family Enter a code for each month, or enter one code in the "all 12 months" box if the same code applies for the entire calendar year "Spouse" means the employee's spouse• If code 2C is applicable AND another code is also , if the employee was offered an ICHRA 5 All 12 months You can use this column if the information was the same for the past 12 months 6 Line 14 Indicates what kind 1095C Cheat SheetACA Reporting Service is the #1 trusted fullservice ACA reporting service for employers We specialize in preparing IRS 1094 & 1095 forms

Form 1095 C Guide For Employees Contact Us

What are the codes for 1095-c

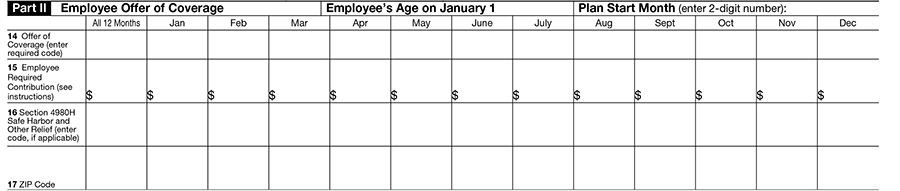

What are the codes for 1095-c-In Part II of Form 1095C, for , the employer is required to input the age of the employee as of January 1st for any employee offered an ICHRA Further, on Line 14, Codes 1L through 1S have been introduced to capture offers of coverage for ICHRAs The addition of these codes induces changes to Part II, Line 15 of the Form 1095C in some cases1095c codes cheat sheet 18;

Aca Code Cheatsheet

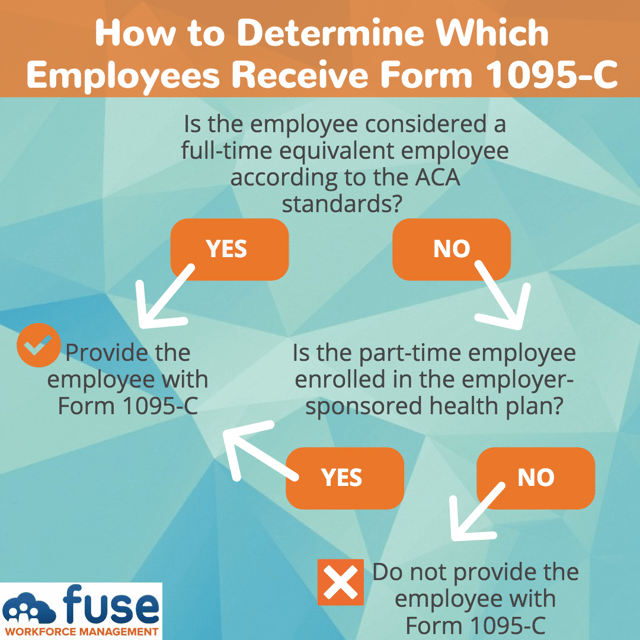

1, The Guide of Record Retention Requirements in the Code of Federal Regulations, as well as by reviewing and analyzing numerous record retention schedules Before finalizing an entity's record retention procedures, it is recommended that the IRS regulations, state and local government retention requirements and the AICPA's Filing and1095 C Code Cheat Sheet Overview 1095 C Code Cheat Sheet can offer you many choices to save money thanks to 13 active results You can get the best discount of up to 78% off The new discount codes are constantly updated onOct 21, · All applicable large employers (ALE) must file Forms 1094C and 1095C with the IRS and furnish a copy of the 1095C to all fulltime employees The insurance carrier for a fully insured plan must complete Forms 1094B and 1095B Generally, only employers that are nonALEs with a selfinsured plan will complete Forms 1094B and 1095B

Oct 29, · The new 1095C codes have not been applicable to any tax years outside of Employers, read on to learn what they mean and how to use them accurately2 minute read We recently covered the ins and outs of the ACA's Form 1095C Now, we will be covering the new codes that are anticipated for the tax1095c codes cheat sheet 19 Make use of a electronic solution to generate, edit and sign documents in PDF or Word format on the web Transform them into templates for multiple use, incorporate fillable fields to collect recipients?Jan 01, · Each code indicates a different scenario regarding an offer of coverage, or explains why an employer should not be subject to a penalty for an employee, for each month ACA 1095 codes cheat sheet Form 1095C Line 14 Code Series 1 Code Series 1 is used for Line 14 of Form 1095C and addresses Whether an individual was offered coverage

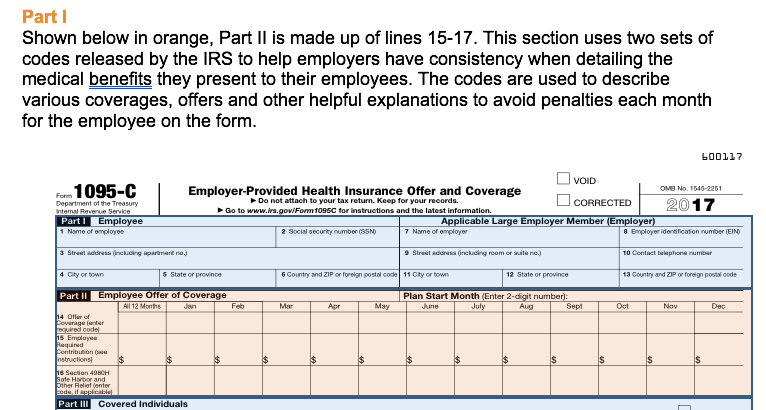

Oct 29, · 1T1Z – These codes were reserved for future use Age – If offered an ICHRA, an ALE must enter in Part II of Form 1095C the age of an employee, as of January 1, Zip Code – If offered an ICHRA, an ALE must enter the ZIP code used for identifying the lowestcost silver plan Updates Impacting All ALEsOur ACA experts break down all 1095 C codes and walk you through how to fill out lines 14, 15, 16, and 17 and Part III Avoid penalties from the IRS learn the differences between codes!Feb 15, 18 · A Cheat Sheet for ACA Codes The Form Below is Form 1095C from the IRS website This guide will explain each piece of the form and help you determine the proper codes for the fields in Part II Shown below in blue, Parts I and III are comprised of lines 113 and 1734, respectively These sections are easy enough, just employee information

1 0 9 5 C O D E S C H A R T Zonealarm Results

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

The IRS has created two sets of ACA codes to provide employers with a consistent way to describe their medical benefit offerings to their employees Each code indicates a different scenario regarding an offer of coverage, or explains why an employer should not be subject to a penalty for an employee, for each monthACA Codes Cheat Sheet JANUARY 19 PAGE 2 Line 16 of Form 1095C or Code Series 2 o Addresses whether the individual was employed during the month and, if so, whether he or she was full time or part time o States whether the employee was enrolled in coverage Again, it is not necessary to show waived plansFeb 24, · When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

1095c codes cheat sheet 21 Get Form form1095ccom is not affiliated with IRS form1095ccom is not affiliated with IRS Home;Review the available codes and definitions for Lines 14 and 16 of Form 1095C• Form 1095C Code Cheat Sheet • Form Instructions (Page 11) Consider grouping employees by code "profile" and starting with the easiest ones first • For example, all employees who were full time all year, offered coverage and enrolled in coverageLet's Look At The Most Common 1095C Coverage Scenarios

Aca Code Cheatsheet

Irs Form 1095 C Codes Explained Integrity Data

· Title VI Grants in Cheat Sheet Title VI FY1719 Awards Project Period April 1, 17 – March 31, Program Report PPR Due September 30, Financial Report SF425 Due September 30, Allowable Use Cheat Sheet 3 To be eligible for FMLA leave 11095c codes cheat sheet 19 Fill out blanks electronically working with PDF or Word format Make them reusable by making templates, include and complete fillable fields Approve forms by using a legal electronic signature and share them by using email, fax or print them out download blanks on your computer or mobile device Boost your productivity with powerfulForm 1095 Code Definitions Lines 14, 15, and 16 Line 14 Offer of coverage code 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for selfonly coverage equal to or less than 95% mainland

trix Irs Forms 1095 C

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

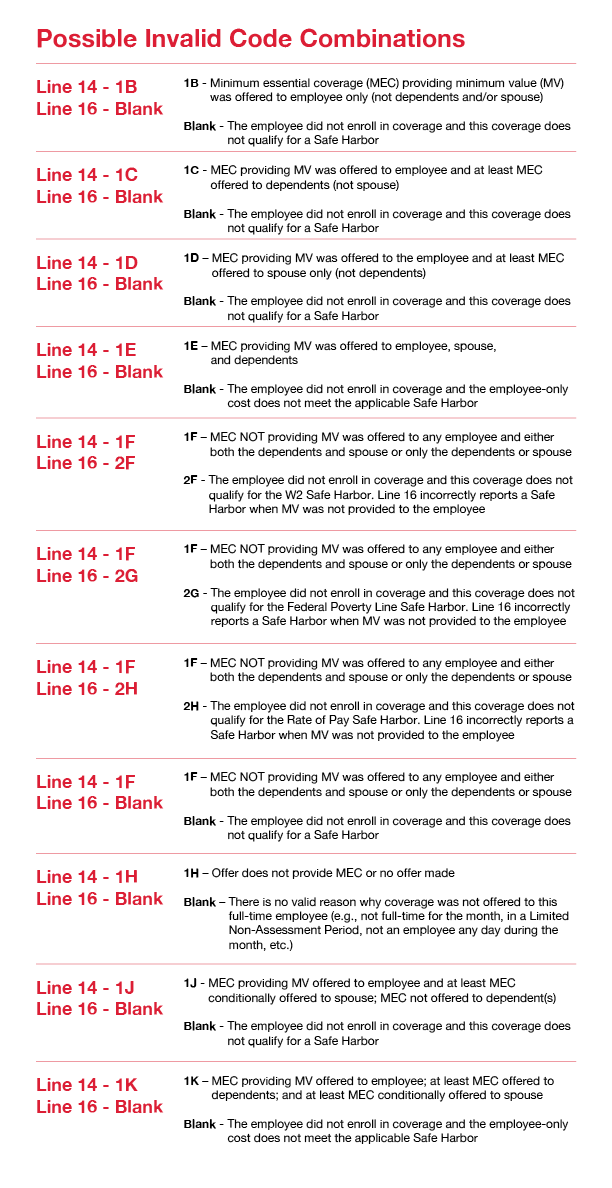

There are several 1095C "Safe" Code Combinations and a few 1095C "Risky" Code Combinations Other factors may trigger inquiries from the IRS, but our hope here is to empower you with the information necessary to properly generate and/or audit 1095C forms A full list of codes is available on our websiteInformation See the Instructions for Part II of Form 1095C, later Also see Individual coverage HRA and Employee Required Contribution, later, for more information on how to calculate the amount reported on line 15 for offers of individual coverage HRAs Plan start month This is required for the Form 1095CView our ACA Codes Cheat Sheet that includes 8 new reporting codes added to the 1095C

1 0 9 5 C O D E S C H A R T Zonealarm Results

Form 1095 C Guide For Employees Contact Us

These codes are selected in Insurance Plan Setup tab of the ACA Companion ApplicationIRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover sheet about the 1095C and isOn July 13, , the IRS released a Form 1095C draft, which adds new 1095C codes from 1L to 1S for employers to indicate the method used to determine their ICHRA plan's affordability Click here to learn more about ICHRA The codes are mentioned here

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Irs Form 1095 C Codes Explained Integrity Data

Understanding how to choose Form 1095C codes for lines 1416 can be overwhelming Managing ACA compliance all year is challenging enough, but it's essential to select the appropriate codes for Forms 1095C If you enter incorrect codes, it could mean ACALine 14 of IRS Form 1095C lists a code that describes whether an employee was offered coverage by their employer, the type of the coverage offered, and for which months the coverage was offered The form generation feature in the Zenefits ACA Compliance app will automatically input the applicable code, which specifies the type of coverage, if any, offered to the employee, theDec 30, 15 · Alright, let's take a look at the 1095C The employee form This is similar to the W2 in that you will issue it to the employees, but you don't need to issue it to parttime employees, only FTE's Below are a few quick tips that will help you to accurately complete these forms You can also get our handy cheat sheet for proper codes here

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

The Complete Aca Reporting Codes Cheat Sheet Blog Acawise Aca Reporting Solution

Codes for Line 14 & 16, Form 1095C;Jul 15, · On July 13, the IRS released the draft iteration of the Form 1095C At first glance, it appears there have been significant changes to the Form 1095C However, in reality, most employers will complete the Form 1095C exactly the way they did in previous years The remainder of this article briefly discusses the changes made in the draft FormForm 1095C Decoder If you were a fulltime employee working 30 or more hours per week or enrolled in healthcare coverage from your employer at any point in , you should receive a Form 1095C If you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn more

Ez1095 Software How To Print Form 1095 C And 1094 C

Aca Form 1095 C Line 14 16 Codes Cheatsheet Section 4980h Safe Harbor Codes

Oct , · October , Know your ABCs Forms 1095A, 1095B, & 1095C Employers and American taxpayers need to understand the ABC's of the Affordable Care Act coverage reporting forms Click on any of the form names below to view the form The link contains the "Instructions to Recipient" page, tooFeb 22, 21 · Below, MP's HR services team provides a refresher on the important evergreen codes for ACA filing and a list of the new ones ACA Reporting Cheat Sheet Form 1095C Line 14 Codes Note that codes 1A, 1E, and 1H are the most commonly used 1A Qualifying Offer You offered a plan that was minimum essential coverage (MEC) and minimumCreating the 1095C spreadsheet to be imported Although you can create your own spreadsheet to import 1095C information for your clients' employees, we recommend that you use the 1095C template spreadsheet that we have made available for exportThe 1095C template spreadsheet exports from Accounting CS populated with basic employee information that is formatted to

Aca Form 1095 C Line 14 16 Codes Cheatsheet Section 4980h Safe Harbor Codes

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Line Code Logic 14 1A1S Employee is ACA Full Time, either set to Yes by a user, or measured as full time employee based on the ACA hours paid An offer of coverage touches the employee's record for the full calendar month (in the ACA Companion > Employee Plan Details);The IRS will not impose a penalty for failure to furnish Form 1095C to any employee enrolled in an ALE member's selfinsured health plan who is not a fulltime employee for any month of if certain conditions are met See Notice 76 and Information reporting penalties Extension of good faith relief for reporting and furnishingInstructions for Forms 1094C and 1095C;

Common 1095 C Scenarios

Preparing For The Affordable Care Act In 16

Online solutions help you to manage your record administration along with raise the efficiency of the workflows Stick to the fast guide to doSep 29, · These codes add to the existing list of codes that employers may use to describe the type of coverage that was offered The additional codes are used to indicate the various types of ICHRA coverage offered by the employer Part III moved Part III is now on Page 3 in the Form 1095C Changes to your Form 1095BACA FORM 1095C CODE SERIES The IRS has designed two sets of ACA codes to provide employers with a way to describe health coverage offers on Form 1095C Each code indicates a different scenario regarding an offer of coverage, Section 4980H Safe Harbor Codes and other relief for ALE Members

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Aca 1095 C Code Cheatsheet

May 09, 18 · Home 18 1095C Codes 18 1095C Codes For more information on how we can support your ACA reporting needs click here Line 14 1A5 new 1095c Codes Cheat Sheet 18 results have been found in the last 90 days, which means that every 18, a new 1095c Codes Cheat Sheet 18 result is figured out As Couponxoo's tracking, online shoppers can recently get a save of 39% on average by using our coupons for shopping at 1095c Codes Cheat Sheet 18TOP Forms to Compete and Sign;

The Aca S 1095 C Codes For The Tax Year What Employers Need To Know About The Aca 1095 C Codes

The Abc S Of Forms 1095a 1095b And 1095c Aca Gps

Information, put and request legallybinding digital signatures Do the job from any gadget and share docs by email or faxThe Complete ACA Reporting Codes Cheat Sheet admin February 21, 18 One of the most important aspects of Form 1095C is knowing how to indicate data about the coverage offered toReference Guide for Form 1094C, Line 22;

Aca Code Cheatsheet Release Notes

Aca Form 1095 C Line 14 16 Codes Cheatsheet Section 4980h Safe Harbor Codes

ACA Reporting Codes Reference Guide for Part II of Form 1095C Lines 14, 15 and 16;CODES FOR IRS FORM 1095C 2F Section 4980H affordability Form W2 safe harbor Enter code 2F if the employer used the section 4980H Form W2 safe harbor to determine affordability for purposes of section 4980H(b) for this employee for the year If an ALE Member uses thisIRS Form 1095C Indicator Codes for Lines 14, 15, and 16 Form 1095C, Part II, Line 14 Indicator Code Series 1 for "Offer of Coverage" 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for self only coverage equal to or less than 95% mainland single

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

ACA Form 1095 C CodeSheet for Line 14 and Line 16 Updated on January , 21 1030am by, TaxBandits Choosing codes to report on lines 14, 15, and 16 of 1095 C might be a tedious process for anyone But, when you look closely, it is pretty much simpleFeb 18, 21 · Key Points about completing Form 1095C You have until March 2, 21 to deliver Form 1095C to your employees The codes you use to complete these forms depend on the coverage you offer, whether your employee enrolls, and other employment changes We outline common example scenarios to help you choose the appropriate codes for lines 14 and 16

1 0 9 5 C C H E A T S H E E T Zonealarm Results

1 0 9 5 C C H E A T S H E E T Zonealarm Results

21 Aca Code Cheatsheet Download Our Free Guide

Aca Form 1095 C Line 14 16 Codes Cheatsheet Section 4980h Safe Harbor Codes

Irs Form 1095 C Fauquier County Va

21 Aca Form 1095 C Line 14 16 Code Sheet By Acawise Issuu

Irs 19 Form 1095 C Now Online Stuttgartcitizen Com

New 1095 C Codes Will Apply To The Tax Year Aca The New 1095 C Codes For Explained

Form 1095 C Instructions For Employers Furnishing Filing

Irs Form 1095 C Codes Explained Integrity Data

The New 1095 C Codes For Explained

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

Aca Code Cheatsheet

Code Series 1 For Form 1095 C Line 14

Common 1095 C Scenarios

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Aca Compliance Hrms Human Capital Management Bizmerlinhr

Aca Code Cheatsheet

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

1 0 9 5 C C H E A T S H E E T Zonealarm Results

A C A 1 0 9 5 C C H E A T S H E E T 2 0 2 0 Zonealarm Results

Irs Form 1095 C Instructions For 21 Step By Step Filing Guide

Aca 1095 C Basic Concepts

Aca Code Cheatsheet

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer

Irs Releases Aca Forms 1094 C And 1095 C Final Instructions

Mental Health Cpt Code Cheat Sheet Pdf

Cobra Retiree 1095 C Form Questions Answered Tango Health

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Irs Announces Changes With Aca Reporting Forms And Instructions Onedigital

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Aca Code Cheatsheet

Aca Code Cheatsheet

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

Mental Health Cpt Code Cheat Sheet Pdf

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

A C A 1 0 9 5 C C H E A T S H E E T 2 0 2 0 Zonealarm Results

1 0 9 5 C O D E S C H A R T Zonealarm Results

Irs Form 1095 C Codes Explained Integrity Data

Irs Form 1095 C Codes Explained Integrity Data

Irs Form 1095 C Codes Explained Integrity Data

Aca Form 1095 C Line 14 16 Codes Cheatsheet Section 4980h Safe Harbor Codes

Aca Code Cheatsheet

1 0 9 5 C C H E A T S H E E T Zonealarm Results

Aca 1095 C Basic Concepts

A C A 1 0 9 5 C C H E A T S H E E T 2 0 2 0 Zonealarm Results

The Codes On Form 1095 C Explained The Aca Times

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

trix Irs Forms 1095 C

Aca Form 1095 C Line 14 16 Codes Cheatsheet Section 4980h Safe Harbor Codes

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Guide To Correcting Aca Reporting Mistakes Onedigital

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Mental Health Cpt Code Cheat Sheet Pdf

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

1 0 9 5 C C H E A T S H E E T Zonealarm Results

Aca Code Cheatsheet

No comments:

Post a Comment